Posts tagged tally prime 5.0 download for free

Tally Prime 5.0 Latest Version Download Free

0

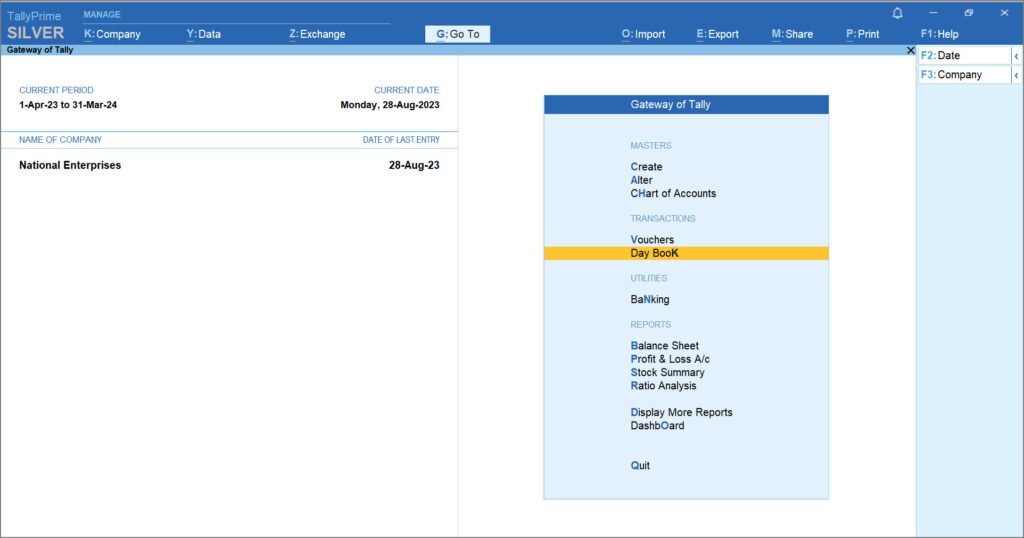

The latest release of tally prime is “TallyPrime 5.0”, which is considered one of the best software for managing the business needs of small and medium-sized businesses. It takes care of accounting, banking, inventory, taxation, and payroll functions to facilitate the smooth running of a growing business.

The new and improved Tally Prime 5.0 is power packed with some amazing new features to provide a seamless user experience for all Tally customers. The new version offers a highly user-friendly interface, improved security features, remote access, and advanced reporting capabilities.

Let us explore the latest features & updates in TallyPrime 5.0 and understand the benefits of this incredible tool.

A] Boost Your Business Performance With These Latest Features And Updates In Tally Prime 5.0

1. Different Tax Rates And HSN Codes Of Stock Items

In the earlier version, it was not possible for businesses to have a stock item with multiple tax rates and HSN codes. But the TallyPrime new version provides flexibility to the users to set up different tax rates and HSN codes for their stocks. It also has a provision to set the sources of GST details and HSN details in transactions.

2. Multiple GSTN Filing In A Single Company Data

This has been one of the long-awaited features of Tally. Users were desperate to have this feature as it can significantly ease the GST compliance management process. A company can have multiple GST numbers if it has separate and distinct businesses. So Tally needed to incorporate a feature to add multiple GST numbers of the same company.

Now you can easily maintain branch-wise GST returns. This is one of the best TallyPrime new features that expedite the filing of GST returns and helps you save a lot of time.

3. Easy And Flexible Configuration

TallyPrime 3.0 offers a simple & flexible yet robust configuration that simplifies your business operations. The software now has an interface that is highly intuitive and user-friendly. The enhanced visual features enable easy navigation for beginners. Further, TallyPrime also allows users to customise the solution to their specific requirements. The users will find that the updated version is super fast & efficient and provides a far better user experience than before.

4. Simple GSTR-2A Reconciliation

The GSTR-2A reconciliation process helps to match the invoices listed in the GSTR-2A document with the invoices recorded in your books. This process helps to match both invoices and detect variations between the two.

The GSTR-2A reconciliation exercise is greatly simplified in the TallyPrime updated version. It helps you to easily identify probable matches to the unreconciled transactions in your books. The transactions can also be marked as reconciled or mismatched, as the case may be. Apart from Excel & CSV, you can also import the GSTR-2A in JSON format.

5. Bug Fixes And New Features In Reports

In the older Tally versions, the voucher number used to get shuffled if you tried to insert or delete a voucher. This bug has been fixed in the new version. Now the deleted voucher number can be reused for a new voucher.

The list of new features in TallyPrime also includes over 120 new report filters. These filters can be added at multiple levels. This can greatly simplify the tasks of finding the required information and analysing data.

To learn more about tally prime reports, read our blog on 8 Crucial Tally Questions That Tally Prime Reports Answer

6. Easy Error Correction

The TallyPrime 5.0 version enables you to spot and fix the errors that occur while importing the data. Once you import the data, Tally shall display a report of exceptions consisting of errors occurring during data import. You can check the report and correct the errors, if any. TallyPrime also marks (e) against the company that has errors in its data. This feature enhances your reporting capabilities and makes your reports more accurate.

7. Simple and Flexible GST Rate Set-Up

The TallyPrime latest release makes it extremely easy to set up GST rates. It offers an interface that is highly intuitive and user-friendly. You can now set up multiple tax rates (including composite rates) for different goods & services. All it takes is a few clicks to configure the GST rates, track your tax liability, and generate accurate returns.

8. Improved Modules For GST Returns

TallyPrime 5.0 makes it a breeze to generate GST returns. The returns can be opened in a jiffy for quick reference. The enhancement of GST reports such as GSTR-1 and GSTR-3B has greatly simplified the process of filing returns. The new version makes it easy to check and monitor your tax liabilities and generate accurate returns. You can now access and file the returns anytime.

With TallyPrime 5.0.1, several key improvements have been introduced to further streamline your return filing experience. Firstly, for transactions with blank HSN/SAC, you can now accept them as they are, reducing the need for additional data entry. Additionally, Iif your firm’s annual revenue is less than Rs 5 crore, HSN/SAC information is not required. This gives you the incredible flexibility to acknowledge such transactions (from Uncertain Transactions) and treat them as enclosed.

Moreover, TallyPrime 5.0.1 has improved the process of filing GSTR-3B using JSON. The GSTR-3B JSON generated by TallyPrime now includes information for all parts and transactions. Additionally, even zero-valued parts will be exported cleanly, allowing you to alter the values on the site as required.

9. Better Data Management

The TallyPrime new version offers superior data management facilities to users. This ensures the seamless migration of data. The users will find it extremely easy to import, synchronise, and repair data when they use the updated version. It is also possible to check the progress of your activity and quickly resolve any issue. Renew your TSS immediately and save a great deal of time and money for your business.

10. Improved E-Invoice Features

Many issues such as mismatches of state and pin code, mismatches of HSN and kind of supply, and invoices that do not begin with zero, have now been resolved. Also, you are now capable of creating e-invoices with real and billing quantities, both.

11. E-Way Billing Along with E-Invoice

According to the recent update, E-Way bills can be generated along with E-Invoicing with efficiency. E-Way billing can also help generate credit notes. What’s more, even if you don’t have a UOM (unit of measures), you can generate an e-Invoice for products and services you’ve purchased.

On the same note, Tally Prime Release 5.0.1 introduced a new auto-calculation feature. This feature calculates the distance between the source and destination locations automatically. This data is then used to generate accurate e-way invoices, minimizing the possibility of minor errors and assuring seamless concurrences.

B] How to Upgrade to TallyPrime 5.0?

Now you can easily upgrade to TallyPrime 3.0 and start using the features in a few minutes by following these steps:

- Visit the website of Tally Solutions.

- Download Tally Prime and install the latest version of TallyPrime from the website.

- Use your TallyPrime credentials to log into the TallyPrime 5.0.

- You also have the option to download TallyPrime 5.0 Beta to get early access.

Conclusion

TallyPrime 5.0 offers several new and advanced features to streamline your critical business functions. It provides a user-friendly interface with rich visuals and smooth navigation. Your data is fully secure due to the advanced security features. The remote access feature in the latest version helps you access the data from anywhere and at any time. Tally Prime 5.0 is fully compliant with GST.

Do not miss out on these amazing benefits. You must upgrade to TallyPrime 5.0 to grow your business without any hitch. But you can only trust a Tally Certified 5-Star Partner with strong expertise to deliver a great customer experience.

Recommended System Configurations for TallyPrime

To install TallyPrime, you require administrator rights (Create, Write, Update, Modify, and Delete permissions). If you are using multilingual features, ensure that the operating system supports multiple languages.

The hardware and software requirements for a Client-Server system and a standalone computer are provided below. This is valid for both TallyPrime Silver and Gold Editions.

| Particulars | Recommended Configuration |

| Processor | 1.8 GHz 64-bit (x64) architecture processor;Core2 Duo, Dual Core, Core i3, Core i5, Core i7 equivalent, or above |

| RAM | 4 GB or more |

| Hard Disk | 150 MB free space to install the application(This excludes the space required to store company data.) |

| Monitor Resolution | 1366 × 768 |

| Operating System | 64-bit editions of Microsoft Windows 7, Windows Server 2008 R2, or above, including Windows 11 |

| Other MS Office software | 64-bit editions of MS Office software such as Excel, Word, and so on |